MetaTrader 4 Made Easy: Simplifying Trading for All

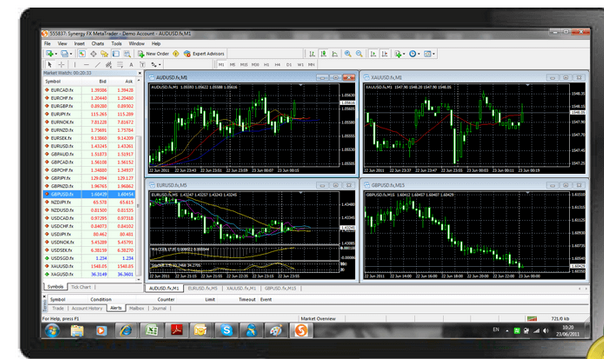

metatrader 4 (MT4) stands as one of the most renowned platforms for forex trading, offering a plethora of tools and features to enhance trading experiences. With its user-friendly interface and extensive capabilities, traders can optimize their strategies to maximize profits. One key aspect that can significantly impact profitability is the utilization of special instructions within MT4. Let’s delve into how these instructions can be leveraged effectively.

1. **Customized Trade Parameters**: MT4 allows traders to set specific trade parameters, including stop-loss and take-profit levels. By utilizing these special instructions, traders can tailor their trades to their risk tolerance and profit objectives. This customization ensures that trades are managed efficiently, minimizing potential losses and locking in profits at predetermined levels.

2. **Advanced Order Types**: MT4 offers various order types beyond the standard market and limit orders. These include trailing stops, OCO (one cancels the other), and IFD (immediate or cancel) orders. By incorporating these advanced order types, traders can automate their trading strategies and react swiftly to market movements, ultimately maximizing profitability.

3. **Technical Analysis Tools**: MT4 is equipped with an extensive array of technical analysis tools, such as indicators and charting capabilities. By utilizing these tools in conjunction with special instructions, traders can identify potential entry and exit points with greater precision. This enables them to capitalize on market trends and effectively manage their trades for optimal profitability.

4. **Algorithmic Trading**: MT4 supports algorithmic trading through the use of Expert Advisors (EAs) and custom scripts. Traders can develop or purchase EAs that execute trades based on predefined criteria, removing emotional biases and ensuring consistent execution of trading strategies. By harnessing the power of algorithmic trading with special instructions, traders can streamline their operations and maximize profits.

5. **Risk Management Strategies**: Effective risk management is crucial for long-term profitability in trading. MT4 allows traders to implement risk management strategies, such as position sizing and leverage control. While flexible leverage is available, it’s essential for traders to exercise caution and avoid excessive risk-taking. By incorporating special instructions for risk management, traders can safeguard their capital and optimize their profit potential.

6. **Continuous Monitoring and Adjustment**: The forex market is dynamic and constantly evolving, requiring traders to adapt their strategies accordingly. With MT4’s real-time monitoring capabilities, traders can stay informed about market developments and adjust their trades promptly. By utilizing special instructions to automate monitoring tasks and trigger adjustments, traders can capitalize on emerging opportunities and mitigate potential risks effectively.

In conclusion, MetaTrader 4 offers a plethora of tools and features that can be leveraged to maximize profits in forex trading. By utilizing special instructions effectively, traders can customize their trades, automate their strategies, and implement robust risk management practices. Ultimately, a disciplined approach coupled with the powerful capabilities of MT4 can lead to sustained profitability in the forex market.