The Benefits of Using a Mortgage Calculator for Your Next UK Property Purchase

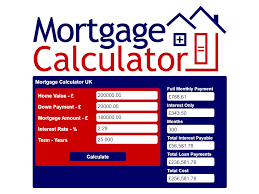

Purchasing a rentals are the single most significant personal judgements many people make, along with guaranteeing are able to afford your mortgage is important to be able to the achievements of your own investment. One of the most impressive instruments open to homebuyers within the UK is really a mortgage calculator. It will assist you to greater view the monetary investment involved with your home purchase. Here are several major benefits of using a Mortgage Calculator UK while arranging your upcoming property purchase.

1. Fast and Exact Monetary Review

Any mortgage calculator means that you can insight various variables, for instance mortgage amount, mortgage rates, and loan phrase, to receive a moment and also appropriate estimation of your per month payments. This saves efforts and guarantees that you’ll be well-informed ahead of committing to your mortgage agreement.

2. Aids Arranged a Reasonable Finances

Simply using a mortgage calculator , it’s easy to decide ideal for afford. The actual software helps you determine the amount you’ll want to acquire in addition to just what exactly the repayments will appear like. This kind of understanding allows you to fixed a sensible price range to avoid overstretching the finances.

3. View the Impression regarding Fascination Charges

Mortgage rates perform a crucial role inside the total cost of your mortgage. Mortgage calculators allow you to create in your mind the issue of various interest rates for your monthly premiums along with whole reimbursement through time. This allows you to generate better conclusions with regards to resolved or even changing rates, helping you see the best choice for ones situation.

4. Review Unique Mortgage Possibilities

Mortgage Calculator UK typically allow you to experiment with different financial loan terms along with settlement wavelengths, providing you with the cabability to review diverse options. No matter if that suits you a new shorter-term loan with regard to faster transaction or perhaps a long term to cut back month-to-month expenditures, the calculator allows you to pick the best fit.

To summarize, using a mortgage calculator is a vital help safe-guarding any mortgage for your UK house purchase. It can help you are making informed selections, strategy your budget, plus choose the best mortgage selection, finally placing people way up to get an effective plus economically environmentally friendly homeownership experience.